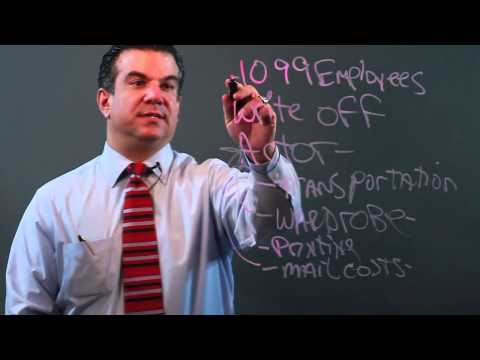

Hi, I'm Isaac Rodriguez, a business consultant. I want to talk to you a little bit about what 1099 employees can write off. First of all, you need to consult your accounting professional. Hopefully, you have a CPA that helps you with your taxes, or perhaps you go to another tax professional once a year to make sure you are deducting the appropriate expenses for your business. In general, what you can write off are things that are related to your industry and the work you do as a 1099 employee. For example, if you are an actor, some things you can write off include transportation to auditions, a portion of your wardrobe if it is necessary for your acting work, the cost of headshots and mailing them, and other expenses related to your acting business. The same goes for any other freelance 1099 consulting person. If your business requires you to be on the phone all the time, you can write off the expenses for your phone usage as a percentage of your overall usage. Remember, you can only write off expenses that are directly related to your business. If you are using your phone for personal reasons, you cannot deduct those expenses. In conclusion, as a 1099 employee, there are certain expenses that you can write off to reduce your taxable income. It is important to consult with a professional to ensure you are following the appropriate guidelines and maximizing your deductions.

Award-winning PDF software

Irs 1099 2025 Form: What You Should Know

If you do not meet the requirements for filing form 1099-INT, contact the return preparer or preparer's agent by the due date to inform them that the applicable filing requirements have not been met. Contact the return preparer or preparer's agent. Use Form 1099-INT for payments over 600,000. For information regarding the 2025 Form 1099-INT filing requirements, see IRM 4.2.5, Information Collection Requirements and Procedures, for additional information on this process. The payment of taxes must be reported by the payee (see IRM 21.1.3.6, Collection Report, for more information about the reporting procedures for payees). The following general rules apply: 1. Payment made on or before the due date must be reported within 3 calendar days of the due date; 2. Payment received on or after the due date but less than three calendar days later must be reported within 4 calendar days of the due date if it is less than 600; 3. Payment received after the due date but less than 4 calendar days later must be reported within 5 calendar days of the due date if it is 600 or more. All returns, schedules and the associated information must be received by the payee, or the payment will not be recognized by the IRS. Additional information about reporting payments. F1040A — Information Return. 2018. Cat. No. 14425J. Information and Disclosure. Payees. Form 1040A can be used to report, with a statement of liability and payment, all taxable payments and wages. All payments or withholding must be made by personal check or the electronic payment system in which the payee resides. The Form 1040A must be filed in the following cases, unless a different form or form amendment is needed: 1. Personal income tax returns. 2. Wages on an employer-paid federal tax withholding transcript. 3. Wages and compensation reports submitted to the IRS. If you cannot file the Form 1040A, contact the income tax preparer to amend it or file Form 1040NR instead. A Form 1040A. File with the federal income tax office where the payee resides. 2018 Notice of Federal Income Tax Filing. 2018. Cat. No. 14425J. Notice of Federal Income Tax Filing. Any wage, salary, commission, bonuses, or tips withheld from an employee in excess of 600 will be reported to the IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1099-MISC 2015, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1099-MISC 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1099-MISC 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1099-MISC 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs 1099 form 2025